Ainsworth Game Technology (AGT), the renowned Australian slot machine developer, is embroiled in escalating power struggles, with recent developments intensifying the internal discord. Founded by Len Ainsworth, the company now faces new challenges as Len’s son, Kjerulf Ainsworth, attempts to increase his influence by proposing a proportional bid to raise his stake from 7.27% to just under 10%.

Kjerulf Ainsworth is positioning himself as a defender of shareholder interests, arguing that AGT is undervalued. His offer of AUD 1.30 per share—30% higher than the current AUD 1.00 per share offer from Novomatic AG—sets the stage for a new confrontation. Novomatic, the Austrian gaming conglomerate, is AGT’s majority shareholder and had previously attempted a full buyout, an effort thwarted by Kjerulf and other minority shareholders.

In communications with shareholders, Kjerulf framed his bid as a vital alternative to the existing offer, suggesting it more accurately reflects AGT’s intrinsic value. While he adheres to regulatory constraints preventing him from surpassing the 10% ownership threshold, he hinted at potential future offers, contingent on market dynamics and investor interest.

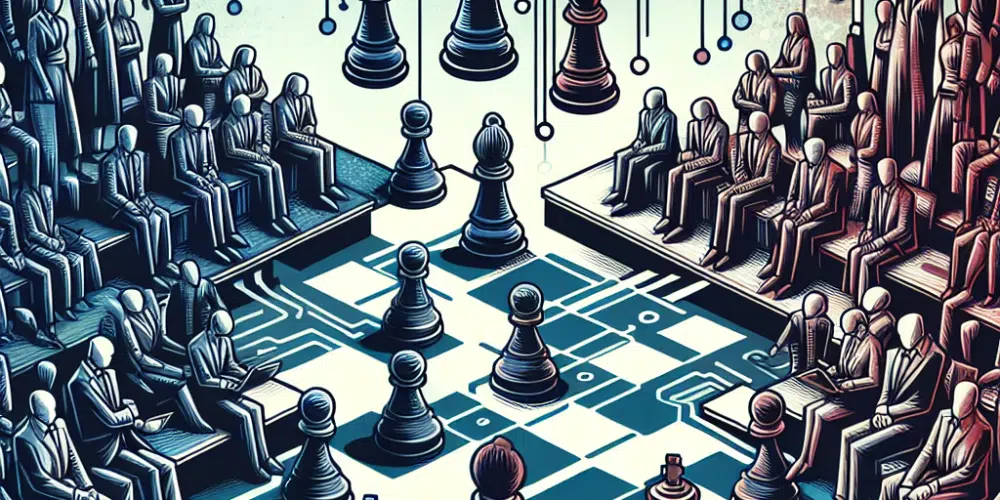

He expressed confidence in his approach, feeling that shareholders should have access to options that better capture the true potential of AGT. Though respectful of the current corporate governance, his move underscores the fractures within the company’s ownership, as Novomatic steadily increases its stake, now at 61.5%, seeking greater operational command. Kjerulf positions his bid as a defense against what some perceive as “foreign dominance,” aiming to reassert Australian influence.

The leadership transitions within AGT further complicate matters. The resignation of CEO Harald Neumann, following advice from the Nevada Gaming Control Board amidst scrutiny in Austria over alleged past misconduct, leaves a leadership void. Ryan Comstock, previously chief operating officer, steps in as interim CEO, bringing a reputation for stability and technical acumen. AGT’s board has initiated a comprehensive search for a permanent CEO, considering both internal and external candidates.

These leadership changes, coupled with the public shareholder battle, place AGT in a delicate situation. Analysts note that Kjerulf’s maneuver, although seemingly modest in scale, signals his intent to shape AGT’s trajectory, serving as both a financial stake and a symbolic assertion of his role in the company’s future.

The broader market context adds layers of complexity. AGT operates in a competitive industry, with technological advancements and regulatory shifts continually reshaping the landscape. Investors’ confidence is crucial, and the internal strife could either prompt strategic realignment or exacerbate uncertainty.

From one perspective, Kjerulf’s actions are a necessary counterbalance in the evolving narrative of AGT, potentially safeguarding shareholder interests in a globalized market. On the other hand, critics might argue that his moves could destabilize corporate cohesion, hampering AGT’s ability to respond agilely to market challenges.

As AGT navigates these tumultuous waters, the unfolding events highlight the intricate dynamics between legacy, control, and market forces, with Kjerulf Ainsworth and Novomatic at the forefront of a strategic tug-of-war. The outcome of these power struggles will likely shape the company’s strategic direction and influence its competitive standing in the global gaming industry.

David Harrison stands tall in gambling journalism, marrying his firsthand casino experiences with a deep understanding of betting psychology. His articles transform complex gambling jargon into engaging tales of strategy and chance, making the world of betting accessible and enjoyable. David’s knack for narrative extends beyond print, making him a sought-after speaker on gambling trends and future bets. In the realm of gambling, David is both a scholar and a storyteller, captivating readers and listeners alike.