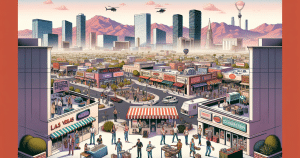

In a strategic move to capture a larger portion of the U.S. gambling market, Bet365 has significantly increased its marketing budget, spending $135 million on new operations in Denver, Colorado, as of July 2025. This move comes at a time when U.S. gaming giants like FanDuel and DraftKings are cutting back on marketing expenses, opting for a more conservative approach.

Bet365, known for its deep pockets and privately-held status, is leveraging its financial resources to gain a foothold in the competitive U.S. market. A survey by Eilers & Krejcik Gaming indicated that Bet365’s promotional outlay for the quarter ending October 2025 was projected to reach 85% of its gross gaming revenue. This aggressive marketing spend underscores the company’s commitment to expanding its presence and customer base in the United States.

Despite the potential impacts on profitability, Bet365’s private ownership means it operates free from the constraints of shareholder pressures. This autonomy allows the company to take more significant risks in marketing to secure market share, a move that may not be as feasible for publicly-traded competitors. However, the gamble with high promotional spending could backfire if it doesn’t translate into long-term customer loyalty and sustainable revenue growth.

The company’s financial maneuvering comes amidst increasing challenges at home in the UK, where proposed gambling tax hikes to 40% are looming. Bet365 has publicly warned that these tax changes could have detrimental effects on its international operations. This development adds another layer of complexity to its business strategy, as the company must balance its aggressive U.S. expansion with the financial ramifications of higher domestic taxes.

There is ongoing speculation that Bet365 might consider going public, a move that could provide an influx of capital but also subject the company to the rigorous scrutiny of public markets. Going public would require transparency about financials and operational strategies, potentially revealing vulnerabilities to competitors and stakeholders.

Historically, the U.S. gambling market has been a lucrative space with substantial growth prospects, especially since the lifting of the federal ban on sports betting in 2018. This change opened the floodgates for both local and international companies to tap into a market that was estimated to be worth billions. With this backdrop, Bet365’s aggressive entry is a calculated risk to establish itself as a dominant player.

While Bet365’s strategy is bold, it’s not without risks. The rapid pace of regulatory changes in the U.S., coupled with the possibility of increased competition as other international players enter the market, could threaten the company’s ability to maintain its market share. Furthermore, excessive promotional spending could strain resources without guaranteed returns, challenging the company’s sustainability if customer retention doesn’t meet expectations.

Moreover, the U.S. gambling landscape is fraught with state-by-state regulatory complexities, where compliance costs and advertising restrictions vary significantly. Bet365 must navigate these intricacies carefully to avoid legal pitfalls that could derail its growth strategy.

Despite these potential hurdles, Bet365’s proactive marketing efforts illustrate a commitment to making significant inroads in the U.S. market. Their approach contrasts sharply with the belt-tightening strategies of their peers, highlighting the company’s willingness to invest heavily in future growth. The outcome of this strategy will likely serve as a bellwether for other international companies considering similar expansions.

However, the company’s long-term success in the U.S. will depend on its ability to balance high customer acquisition costs with sustainable profitability. In an industry where margins are tight and competition is fierce, achieving this balance will be crucial.

In conclusion, while Bet365’s current strategic direction is ambitious, it must tread carefully to ensure that its bold expenditure translates into a lasting market presence. The company’s ability to adapt to changing market conditions, regulatory environments, and competitive pressures will determine its success in the ever-evolving landscape of U.S. gambling. As Bet365 moves forward, its actions will likely be closely monitored by industry analysts and competitors alike, offering insights into the dynamics of aggressive market expansion in a conservative economic climate.

Garry Sputnim is a seasoned journalist and storyteller with over a decade of experience in the trenches of global news. With a keen eye for uncovering stories that resonate, Alex has reported from over 30 countries, bringing light to untold narratives and the human faces behind the headlines. Specializing in investigative journalism, Garry has a knack for technology and social justice issues, weaving compelling narratives that bridge tech and humanity. Outside the newsroom, Garry is an avid rock climber and podcast host, exploring stories of resilience and innovation.