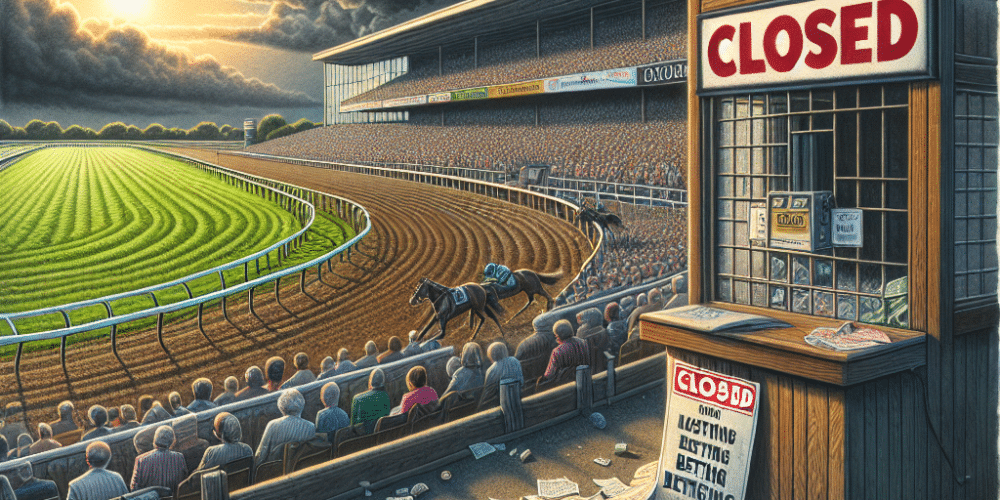

Independent bookmaker Macbet has announced that starting October 1, it will cease offering bets on Arena Racing Company (ARC) tracks. This decision comes as a direct response to ARC’s recent transition to a turnover-based data fee model, a move that Macbet argues is unsustainable under its current operational structure. The news was shared via Macbet’s social media, reflecting a growing tension within the horse racing industry, especially in light of the UK government’s recent betting tax increase.

Previously, Macbet, along with other bookmakers, paid a static fee of £15,000 for access to the racing data rights associated with ARC tracks. However, this arrangement has been replaced by a 2% levy on betting turnover. For a company like Macbet, which prides itself on accommodating winning customers, this new financial burden poses a significant challenge.

Macbet has emphasized that the decision to halt betting on ARC tracks was not made lightly. They are considering potential adjustments to their offerings, such as introducing higher-margin books specifically for ARC races or applying a surcharge for events at ARC venues. Nevertheless, they remain firm that under the current economic landscape, maintaining operations as usual is not viable.

In a statement released by the company, Macbet clarified that from October 1 onwards, their platform will no longer support betting on any Arena Racing Company racetracks. The response from the industry has been one of mixed emotions, though largely sympathetic. Many insiders fear that escalating costs could edge smaller bookmakers out of the market, leading to further consolidation around larger gambling entities.

The horse racing sector in the UK is feeling the strain, with the government’s proposed tax hike looming. The plan to harmonise online betting duties could see the tax rate jump from 15% to 21%, potentially siphoning £330 million from the sector in the first five years and risking nearly 3,000 jobs within the first year alone.

Studies by Regulus Partners and Development Economics underline the disproportionate impact this tax change would have on horse racing. Racing’s unique reliance on betting turnover means the proposed tax could lead to reduced investments, a decline in horse ownership, the diminished viability of racecourses, and lower prize money. For ARC, aligning revenue more closely with betting activity via the new data fee model may seem like a strategic move to mitigate these pressures.

However, this shift poses existential challenges for smaller and medium-sized bookmakers like Macbet. Unlike industry giants, who can offset racing turnover with revenues from other sectors such as iGaming and sports betting, smaller operators face a harsher reality. The new cost structure limits their ability to compete, raising concerns about the future landscape of the betting industry.

While Macbet explores ways to adapt to these changes, the broader challenges facing the horse racing industry remain formidable. The combination of increased data fees and potential tax hikes adds to the complex puzzle of maintaining profitability and ensuring the sector’s sustainability.

One industry analyst remarked on the situation, noting that while larger companies may weather these changes through diversified portfolios, smaller operators are left grappling with tough decisions. The analyst reflected the sentiment that many bookmakers, like Macbet, are caught between maintaining competitive offerings and ensuring their financial viability.

Conversely, proponents of the ARC’s new fee structure argue that linking data fees to betting turnover aligns better with actual usage and incentivizes more responsible betting practices. They contend that this model could ultimately lead to a more equitable distribution of revenue within the industry.

Nevertheless, the debate continues. Critics argue that the shift could stifle competition and innovation, leaving the market dominated by a few large players. The balance between fair competition and financial sustainability remains a delicate issue, one that the industry must navigate carefully.

As the situation unfolds, stakeholders in the horse racing sector are watching closely. The outcome will not only impact bookmakers like Macbet but also have broader implications for the industry as a whole. The coming months will be crucial in determining whether smaller operators can adapt or if the market will indeed consolidate around larger, more financially resilient firms.

David Harrison stands tall in gambling journalism, marrying his firsthand casino experiences with a deep understanding of betting psychology. His articles transform complex gambling jargon into engaging tales of strategy and chance, making the world of betting accessible and enjoyable. David’s knack for narrative extends beyond print, making him a sought-after speaker on gambling trends and future bets. In the realm of gambling, David is both a scholar and a storyteller, captivating readers and listeners alike.