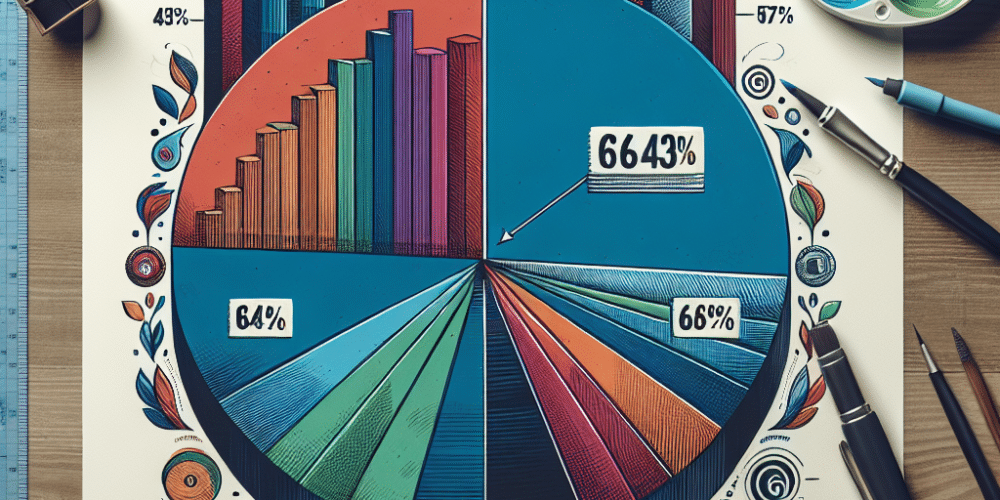

MIXI Australia, the subsidiary of the prominent Japanese tech conglomerate MIXI, has bolstered its position in the Australian sports betting industry by increasing its stake in PointsBet. As of September 12, 2025, MIXI’s shareholding has surged from 61.58% to a commanding 66.43%, marking a decisive step in their strategic acquisition efforts that began earlier this year. The acquisition was achieved through a strategic combination of on-market share purchases priced at AUD 1.25 per share and acceptances from the company’s ongoing takeover bid. This strategic maneuver underscores MIXI’s steadfast commitment to securing a majority stake despite facing competitive pressure from Betr Entertainment, a rival bidder in the market.

This incremental acquisition grants MIXI 230,893,535 shares of PointsBet, securing significant voting power and influence over company decisions. MIXI’s strategy reflects the broader industry trend where major tech companies are increasingly investing in the lucrative sports betting market, recognizing its potential for substantial financial returns and strategic growth opportunities. The company’s decisive actions are a testament to its long-term vision to solidify its footprint in this vibrant sector, which has witnessed exponential growth driven by digital transformation and changing consumer behaviors.

In contrast, Betr Entertainment’s approach to acquiring PointsBet involved an all-scrip offer, proposing an exchange of more than four of its own shares for every PointsBet share. Betr strongly believed that their proposal offered superior value by capitalizing on potential synergies that could realize significant financial benefits. However, the leadership at PointsBet has favored MIXI’s cash offer, considering it a safer and more reliable option amidst volatile market conditions. The cash offer provides immediate liquidity and certainty, which is particularly appealing given the unpredictable nature of stock market valuations.

Despite Betr’s assertion of creating enhanced value through strategic synergy, PointsBet’s board remained unconvinced and thus reluctant to shift allegiance from MIXI’s more tangible and immediate financial offering. The board’s decision reflects a cautious approach in ensuring stability and minimizing risk in an industry known for its competitive volatility.

The fierce competition between MIXI and Betr has been emblematic of the dynamic and often unpredictable nature of mergers and acquisitions within the sports betting industry. PointsBet’s decision to exclude any Betr representatives from its board of directors highlights a strategic move to maintain operational independence and avoid potential conflicts of interest that could arise from allowing a rival bidder influence over company decisions. This prudent move is indicative of a broader trend where companies prioritize autonomy and strategic alignment, especially during periods of ownership transitions.

While MIXI’s increased stake in PointsBet signals a victory in this competitive bid, it also places the company in a position of responsibility to ensure that it can deliver on its strategic promises. Stakeholders will closely scrutinize MIXI’s ability to enhance PointsBet’s market position and leverage its resources to drive long-term growth. MIXI’s track record as a leading tech corporation suggests that it has the necessary expertise and resources to navigate the complexities of the sports betting landscape, yet it must also remain adaptive to the evolving regulatory and competitive challenges inherent in this sector.

Conversely, Betr’s setback in acquiring PointsBet could compel the company to reconsider its strategic priorities and explore alternative pathways for growth and expansion. By focusing on potential mergers with other entities or strengthening its core operations, Betr may yet find opportunities to secure its desired market position. The competitive dynamics in the sports betting industry present numerous avenues for growth, provided companies like Betr can successfully harness innovative strategies and partnerships.

As the dust settles on this acquisition battle, the sports betting industry continues to be a hotbed of activity and opportunity. Stakeholders within the field are keenly observing how major players like MIXI will shape the future landscape, leveraging technological innovation and market insights to drive both immediate gains and sustainable growth. As companies maneuver through this complex and rapidly evolving industry, strategic foresight and adaptability will be critical in ensuring long-term success and resilience amidst the shifting tides of consumer demand and regulatory developments.