Overview of New York State’s Casino Tax Breaks

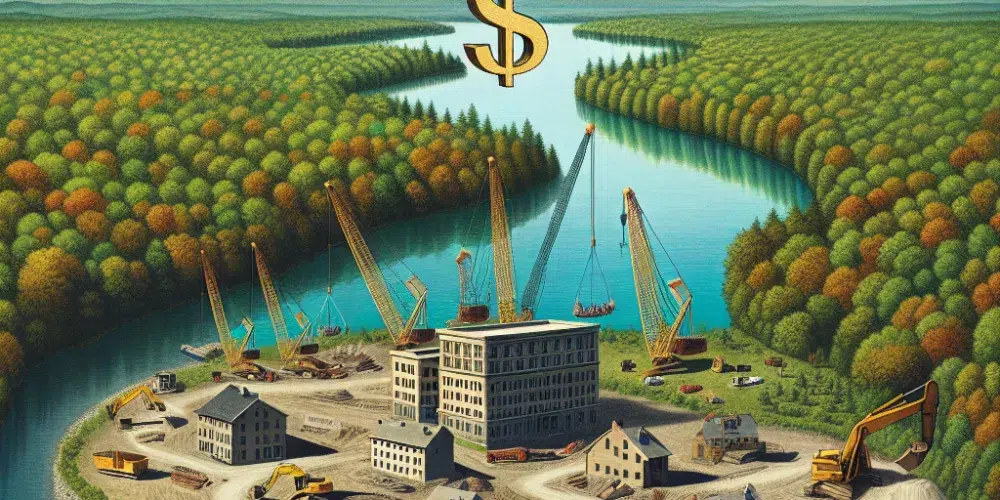

On March 15, 2024, New York legislators passed a significant measure to offer tax breaks to casinos located in the upstate region. This initiative aims to revitalize local economies, stimulate tourism, and create thousands of jobs across regions that have suffered economic downturns. The legislation specifically targets properties that have struggled financially, providing them with a financial lifeline to potentially enhance operations and expand local employment opportunities.

Specific Benefits Outlined in the Legislation

The newly approved policy allows selected casinos to benefit from a reduced tax rate on gaming revenues, from the current average of 40% down to 25% for the next five years. Additionally, the law includes provisions for investments in non-gaming amenities such as hotel accommodations, live entertainment facilities, and conference spaces, extending a further 10% tax rebate on these expenditures.

Impact Analysis on Local Economies

Economic analysts predict that these tax incentives could lead to a surge in local and regional economic activities. By making it financially viable for casinos to expand and enhance their facilities, more tourists and recreational gamblers could be attracted to the areas. “The expected influx of visitors should significantly boost other local businesses, including restaurants, retail outlets, and recreational services,” explained Emily Thomson, a regional economic development consultant.

Employment Opportunities and Training Programs

Casinos benefiting from this tax break are also required to implement job creation plans. According to the legislation, each casino must demonstrate how they will use the tax savings to create at least 150 new jobs within the next three years. “This initiative is not just about tax reductions; it’s a strategic move to bolster employment and ensure sustainable growth,” stated Senator John Malloy, a proponent of the bill.

Critical Responses and Concerns

While many local leaders and business owners have praised the decision, there are significant concerns among critics who argue that the tax breaks may lead to increased social issues, such as gambling addiction. Furthermore, some economists are skeptical about the long-term benefits of this approach, fearing that once the tax incentives expire, casinos might revert to previous operational levels without a genuine long-term economic contribution.

Public Reactions and Adjustments to the Legislation

The passage of the bill has stirred public debate on the role of gambling in economic development. In response to concerns, legislators have amended the initial proposal to include tighter regulations on gambling practices and increased funding for problem gambling support programs. “It’s crucial that as we advance these economic policies, we also strengthen our social safety nets to protect our communities,” commented Assemblywoman Lisa Hendricks.

Future Prospects for Upstate New York’s Casino Industry

Looking ahead, the future of upstate New York’s casino industry appears poised for significant change. With the tax breaks set to commence in July 2024, participating casinos are already planning expansions and new marketing campaigns to capitalize on potential growth opportunities. The effective monitoring and adaptation of these policies will be essential to their success and acceptance, particularly in balancing economic benefits with social responsibilities.

Key Takeaways

FAQs

Which casinos are eligible for the tax breaks?

Eligible casinos are those in the upstate New York region that have shown financial struggles and can commit to outlined employment and investment criteria.

How will the tax breaks affect employment?

Casinos must demonstrate job creation plans, committing to create at least 150 new jobs over three years.

What measures are included for addressing problem gambling?

The legislation increases funding for gambling addiction programs and implements stricter gambling oversight.

Garry Sputnim is a seasoned journalist and storyteller with over a decade of experience in the trenches of global news. With a keen eye for uncovering stories that resonate, Alex has reported from over 30 countries, bringing light to untold narratives and the human faces behind the headlines. Specializing in investigative journalism, Garry has a knack for technology and social justice issues, weaving compelling narratives that bridge tech and humanity. Outside the newsroom, Garry is an avid rock climber and podcast host, exploring stories of resilience and innovation.