In 2024, Northern Ireland experienced a significant reduction in the number of gaming machines with higher payouts, according to the latest report from the Department for Communities (DfC). The report reveals a 38 per cent decrease in machines with a maximum £25 payout. These figures present a stark contrast to previous years when the gaming sector in Northern Ireland showed different trends.

The report highlights that there were 112 amusement permits in effect, covering 6,410 gaming machines with a maximum £25 payout, and 23 permits for 549 machines with a maximum £8 payout. This marks a slight decrease in the number of licences: one less for the £25 payout machines and two fewer for the £8 payout machines compared to the previous year. While the decline in licenses is relatively minor, the sharp drop in the number of £25 payout machines is significant, indicating a possible shift in the market dynamics.

The landscape of gambling in Northern Ireland also includes 36 operational bingo club licences, 280 bookmaking office licences, and 106 bookmakers’ licences. Despite these numbers, the overall number of VAT or PAYE-registered gambling businesses decreased over the last decade, moving from 95 in 2015 to 80 in 2024. However, in 2025, there has been a small resurgence, with the number rising to 85.

Gambling turnover figures paint a picture of decline as well. In 2023, the total turnover was £170.9 million, which represents a drop of more than 75 per cent from the figures reported in 2016. These statistics underscore the challenges faced by the land-based gambling industry in Northern Ireland as it navigates through changes in consumer behavior and regulatory pressures.

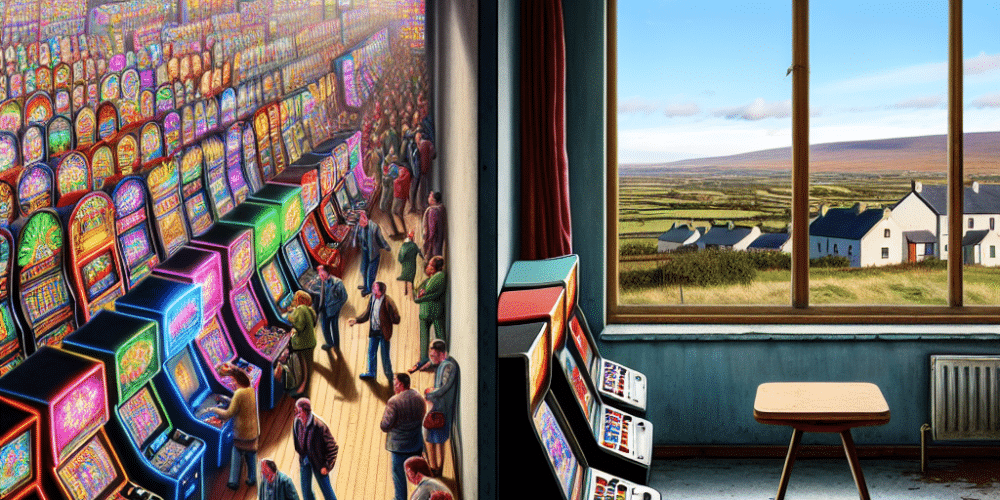

Online gambling, a growing sector globally, is noticeably absent from Northern Ireland’s regulatory framework. Unlike its neighbors—the UK and the Republic of Ireland—Northern Ireland has not yet regulated online gambling, leading to missed opportunities in capturing revenue from this burgeoning sector. This regulatory gap has prompted criticism and debate among Northern Irish legislators, who argue that the region is lagging behind.

The Republic of Ireland has recently implemented new gambling legislation, establishing the Gambling Regulatory Authority of Ireland. This new body aims to start processing licence applications soon. The legislation also includes the creation of a gambling social impact fund, financed through a levy on gambling, along with new advertising and promotion regulations. These changes reflect a proactive approach to modernizing and controlling the gambling industry.

In contrast, Northern Ireland remains under the regulatory framework of the UK, yet it has not been included in the distribution of funds from the British gambling levy introduced in April 2023. Criticism has been directed at the British government for this exclusion, which some see as a missed opportunity to address gambling-related social issues in Northern Ireland. Additionally, there is ongoing pressure for the British Department for Culture, Media and Sport (DCMS) to impose stricter advertising restrictions. A recent survey highlights public sentiment: 66 per cent of respondents believe there are too many gambling advertisements, and 71 per cent support implementing a watershed for gambling ads on TV and radio.

However, some industry advocates argue that the decline in gaming machines and gambling turnover is not solely due to regulatory challenges. They point to changing consumer habits, with more players opting for online gaming options, which are easily accessible and often more convenient. This shift may continue to influence the reduction in traditional gambling establishments and machines.

Despite the challenges, there are calls from within the industry for Northern Ireland to embrace change and adapt to new market conditions. By looking at the examples set by its neighbors, Northern Ireland could potentially revitalize its gambling landscape. One perspective suggests that, with proper regulation and strategic investments, the gambling sector could once again flourish.

A second viewpoint acknowledges these potential benefits but cautions that any attempt to revitalize the industry must be carefully balanced with social responsibility. The establishment of a comprehensive regulatory framework that includes provisions for problem gambling and social impact assessments could ensure that growth does not come at the expense of community well-being.

The conversation around gambling in Northern Ireland remains complex and multifaceted. While the current data reflects a declining trend in traditional gaming machines, the potential for growth in online gambling remains untapped. As pressure mounts on legislators to modernize the regulatory environment, the future of Northern Ireland’s gambling industry hangs in the balance, requiring careful consideration of both economic potential and social impacts.

David Harrison stands tall in gambling journalism, marrying his firsthand casino experiences with a deep understanding of betting psychology. His articles transform complex gambling jargon into engaging tales of strategy and chance, making the world of betting accessible and enjoyable. David’s knack for narrative extends beyond print, making him a sought-after speaker on gambling trends and future bets. In the realm of gambling, David is both a scholar and a storyteller, captivating readers and listeners alike.