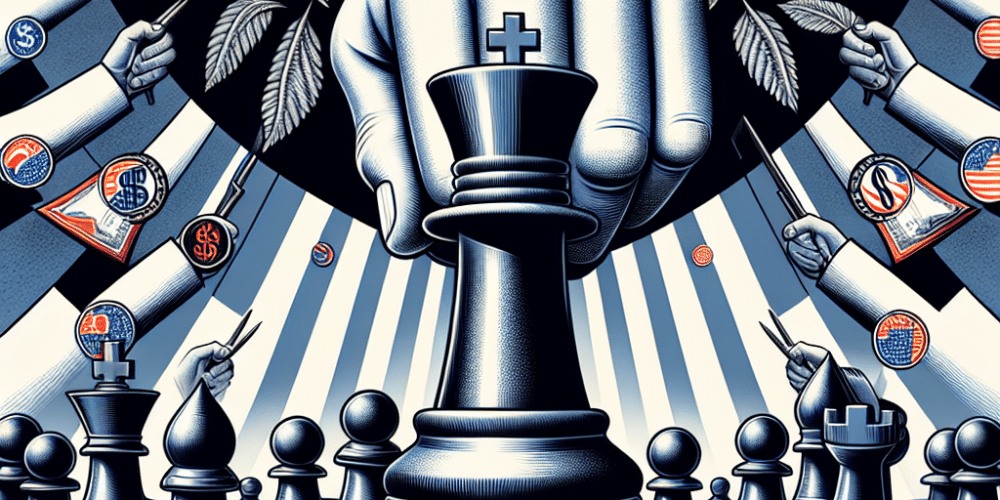

The Commodity Futures Trading Commission (CFTC) is navigating a complex landscape as it faces mounting pressure to clarify the legal status of prediction markets in the United States. While state regulators are increasingly critical of event-based contracts, the CFTC has recently shown support for the tokenized financial systems that are integral to modern prediction markets. This endorsement comes at a time when state-level pushback against these platforms is becoming more pronounced.

At the Futures Industry Association Expo held in Chicago, acting CFTC chair Caroline Pham emphasized that blockchain-driven markets represent more than mere speculative ventures. She highlighted these offerings as part of the broader evolution occurring within global trading systems. Pham argued that the 24-hour nature of international financial markets necessitates tools that traditional banking infrastructures struggle to provide, with stablecoins emerging as an ideal solution.

Pham’s comments are in line with the CFTC’s “Crypto Sprint” initiative, which aims to integrate stablecoins and other tokenized assets into collateral systems used for derivatives trading. She posited that both tokenized finance and prediction markets are products of a significant technological shift, suggesting that regulators should embrace rather than resist these innovations. Transformational technologies, she noted, do not arrive fully formed; they develop through responsible experimentation, robust public-private collaboration, and forward-thinking regulatory frameworks.

She further asserted that prediction markets align well with core market oversight principles, including integrity, customer protection, and risk management. Her sentiments were echoed by SEC Commissioner Hester Peirce, who has encouraged companies to seek the Commission’s guidance when delving into tokenized securities.

Despite federal support, state regulators have shown considerable resistance. Kalshi, a platform with a CFTC license as a regulated futures exchange, has faced intense scrutiny after introducing contracts tied to NFL and NHL games. Many states contend that the platform is using its federal status to offer sports betting under the guise of futures contracts in jurisdictions where such activity is illegal.

Legal experts indicate that the conflict centers around a critical distinction: whether futures contracts can legitimately cover outcomes like sports results, or if this crosses into gambling territory, which is subject to state regulation. The CFTC has yet to make a definitive ruling on the matter. While federal officials uphold that states can enforce their own gambling laws, prediction markets continue to use their federal oversight as a defense.

The ambiguity is causing increasing frustration among state regulators, gambling operators, and tribal authorities. The Pennsylvania Gaming Control Board recently issued a warning, stating that prediction platforms could undermine existing regulatory frameworks. Similarly, Nevada officials have taken a stringent approach. However, these legal challenges have not deterred platforms like Kalshi, which continues to promote its ability to offer contracts on game outcomes across all 50 states.

Critics argue that the current legal limbo creates an uneven playing field. State gaming authorities, who follow strict regulatory protocols, see prediction markets as a threat to their carefully managed systems. They argue that if platforms like Kalshi can circumvent state laws, it could potentially open the floodgates for unregulated betting practices, thus undermining local regulatory efforts.

Proponents of prediction markets, however, argue that these platforms provide valuable insights and financial instruments that can be used for hedging and information discovery. They assert that the markets are a legitimate part of financial innovation, not merely another form of gambling. To them, prediction markets are akin to other novel financial instruments that have been integrated into mainstream finance with appropriate regulatory oversight.

As the debate continues, the CFTC finds itself at a crossroads. The agency must balance innovation with regulation, ensuring that prediction markets can thrive without compromising the integrity of state regulatory systems. With state and federal authorities at odds, a resolution will require careful negotiation and possibly new regulatory frameworks that bridge the divide.

The ongoing conflict highlights the broader challenges faced by regulators in the era of digital finance. The rapid pace of innovation often outstrips the development of regulatory policies, leading to conflicts and uncertainty. Stakeholders on both sides agree that clear guidelines are needed to provide a stable environment for both traditional and innovative financial markets.

In conclusion, as the CFTC weighs its options, it remains to be seen how prediction markets will be governed in the future. The outcome will likely set a precedent for how emerging financial technologies are regulated in the United States, impacting not only prediction markets but potentially other sectors of the digital economy. The need for a balanced approach that fosters innovation while protecting consumer interests is more critical than ever.

Garry Sputnim is a seasoned journalist and storyteller with over a decade of experience in the trenches of global news. With a keen eye for uncovering stories that resonate, Alex has reported from over 30 countries, bringing light to untold narratives and the human faces behind the headlines. Specializing in investigative journalism, Garry has a knack for technology and social justice issues, weaving compelling narratives that bridge tech and humanity. Outside the newsroom, Garry is an avid rock climber and podcast host, exploring stories of resilience and innovation.