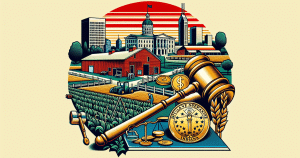

The IRS Criminal Investigation unit (IRS-CI) has ramped up its efforts to combat illegal sports gambling, coinciding with the onset of the football season, which always brings a spike in betting activity. The IRS-CI has focused on a broad array of offenses tied to illegal gambling, underlining the importance of staying within legal boundaries for bettors. Each year, the IRS initiates over 30 investigations into illegal gambling activities, achieving a striking 92% conviction rate for those that are prosecuted. Over the past five years, this has resulted in the conviction of 96 individuals, with sentences ranging from five to 33 months.

On September 2, IRS-CI Chief Guy Ficco highlighted an emerging trend where online crypto casinos are increasingly offering sports betting services. Many of these platforms are based offshore and deliberately forgo know-your-customer (KYC) measures, making them appealing to users wishing to maintain anonymity, often for illicit purposes. Ficco stressed that it is crucial for gamblers to ensure they are betting legally and safely, particularly in an era where digital currency and online platforms are expanding rapidly.

The IRS has issued guidance to bettors, stressing the importance of using state-licensed gambling platforms. This advice comes as football season sees a surge in betting activities, with many bettors tempted by the convenience and privacy offered by offshore and cryptocurrency-based sites. However, these platforms often operate without stringent regulatory oversight, potentially engaging in or facilitating illegal activities. The agency warns that all gambling winnings are subject to taxes and must be reported as taxable income. Failing to do so can lead to severe civil and criminal penalties.

The IRS-CI also cautions against betting on behalf of others or engaging in gambling activities that could be construed as attempts to disguise the source of funds. Such actions could implicate individuals in money laundering schemes, adding another layer of legal risk for unsuspecting bettors. The agency advises anyone with uncertainties regarding their tax responsibilities related to gambling income to consult qualified tax professionals or refer to the official IRS resources. Ignorance of tax laws, the agency warns, does not exempt individuals from their legal obligations.

Despite these warnings, the allure of crypto and offshore gambling platforms remains strong for some bettors. The anonymity and ease of access offered by these platforms are appealing, especially to those who might be wary of the more transparent and regulated state-licensed options. This presents a challenge for regulators and law enforcement, as the global and decentralized nature of these platforms makes them difficult to monitor and control. Nevertheless, the IRS-CI remains adamant about pursuing these illegal activities, leveraging technological advances and international cooperation to track down and prosecute offenders.

One perspective argues that the growing popularity of crypto casinos is a natural evolution in the gambling industry, which has always been quick to adopt new technologies. Proponents suggest that blockchain technology can offer transparency and fairness in gambling, providing an alternative to traditional methods. However, detractors point out that the lack of regulation and oversight on these platforms creates a fertile ground for illegal activities, including money laundering and tax evasion.

As the debate continues, the focus remains on ensuring that gambling activities are conducted legally and safely. With the football season in full swing, bettors are encouraged to be vigilant and to understand the legal implications of their activities. The IRS’s clear message is that the convenience and allure of illegal gambling are no match for the potential legal troubles and penalties that could follow. As one might conclude, the risks outweigh the benefits when it comes to illegal sports gambling, and wisdom lies in staying on the right side of the law.

The IRS’s proactive stance aims not only to enforce compliance but also to educate the public about the potential pitfalls of illegal gambling. By focusing on both enforcement and awareness, the agency seeks to foster a betting environment that is fair, transparent, and within the legal framework. This dual approach is crucial in a landscape where the lines between legal and illegal gambling can often blur, particularly with the advent of new technologies and platforms.

In conclusion, as legal sports betting gains traction, the IRS’s efforts underscore the importance of adhering to legal guidelines. With significant resources dedicated to monitoring and prosecuting illegal activities, the agency is sending a clear signal that illegal sports betting will not be tolerated. As the football season brings increased betting activity, bettors are reminded to place their bets wisely and legally, ensuring that their enjoyment of the game does not lead to unintended legal consequences.

David Harrison stands tall in gambling journalism, marrying his firsthand casino experiences with a deep understanding of betting psychology. His articles transform complex gambling jargon into engaging tales of strategy and chance, making the world of betting accessible and enjoyable. David’s knack for narrative extends beyond print, making him a sought-after speaker on gambling trends and future bets. In the realm of gambling, David is both a scholar and a storyteller, captivating readers and listeners alike.