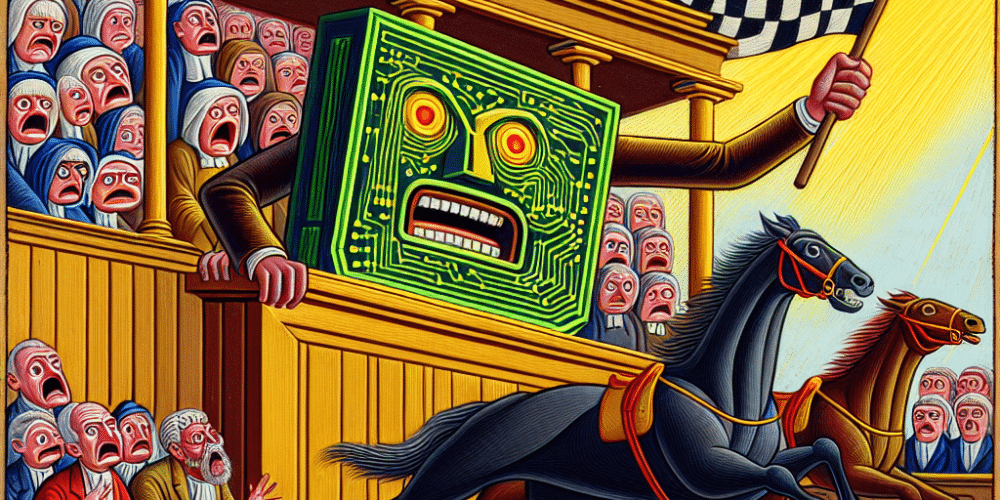

In a legal action that could reshape the horse racing industry, Hagens Berman has filed a lawsuit against several prominent entities in the sector, including the Stronach Group, Churchill Downs, and the New York Racing Association (NYRA). The lawsuit, lodged in the US District Court for the Eastern District of New York, alleges that these organizations collude to benefit anonymous bettors using computer-assisted wagering (CAW) platforms, to the detriment of regular gamblers.

The legal complaint targets not only these key players but also data processing firms such as AmTote International and United Tote. The former is owned by the Stronach Group, while the latter is affiliated with both Churchill Downs and NYRA. The lawsuit contends that bettors utilizing CAW platforms gain an unfair edge over traditional bettors, who are left at a distinct disadvantage.

In horse racing, odds are typically set by the bettors, creating opportunities for manipulation that can disadvantage ordinary punters. The lawsuit emphasizes that CAW users, who often place bets mere seconds before a race begins, enjoy lower fees and receive rebates that are not available to other bettors. This preferential treatment allegedly allows CAW users to partake in what the complaint describes as “no-risk, no-loss” gambling, undermining the fairness of the betting process.

The lawsuit further argues that the identity and financial sources of these CAW users are obscured, potentially contravening the Racketeer Influenced and Corrupt Organizations Act (RICO). This lack of transparency raises significant concerns about the ethical and legal implications of such practices within the industry.

Critics within the industry point out that while CAW platforms might seem to bring technological advancement, they simultaneously exacerbate inequalities among bettors. One industry insider remarked that regular punters feel they’re “up against a well-oiled machine that’s always two steps ahead.”

Conversely, defenders of CAW platforms argue that they inject much-needed liquidity into the betting pools, which can benefit the industry as a whole. They suggest that rebates and reduced fees are simply part of incentivizing high-volume betting, which can ultimately stabilize the market.

However, for many traditional bettors, the perception remains that the deck is stacked against them. The lawsuit aims to challenge these practices and seek remedies that could level the playing field for all participants.

As the case unfolds, it promises to scrutinize the dynamics of how odds are set and manipulated within the competitive world of horse racing. The implications could extend beyond just rule changes, potentially influencing how data and technology are integrated into other betting markets.

A key aspect of the lawsuit is the emphasis on transparency and fairness. It calls into question not only the operations of CAW platforms but also the broader regulatory environment that allows such disparities to exist. The case could prompt regulatory bodies to reassess existing frameworks and enforce stricter oversight to prevent future collusions.

In conclusion, this lawsuit presents a critical examination of the horse racing industry, posing significant questions about fairness, transparency, and the role of technology in sports betting. As stakeholders on all sides prepare for a potentially lengthy legal battle, the outcome may redefine the boundaries between innovation and equity within the sport.