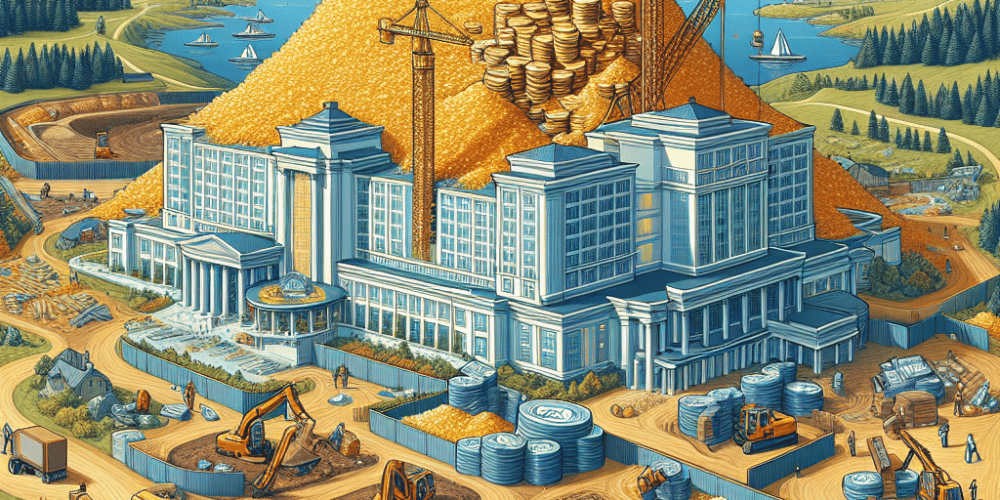

Gaming and Leisure Properties, Inc. (GLPI) has taken a pivotal role in the development of a significant gaming and entertainment endeavor, the $1.4 billion Live! Casino & Hotel Virginia project in Petersburg. This ambitious venture underlines the strategic importance of aligning real estate dealings and financing to navigate the inherent risks while maximizing the rewards in the gaming industry.

Central to the project’s financial structure, GLPI has committed to a $27 million land purchase along with $440 million dedicated to hard cost financing, all maintained at an 8.0% capitalization rate. The strategic purchase of land and subsequent financial backing not only facilitate the construction phases but also underscore GLPI’s investment philosophy of acquiring premium gaming properties under favorable terms.

The sprawling development, strategically located off I-95, encompasses 98 acres and is set to include a variety of amenities. Beyond the casino, it will feature hotels, retail outlets, dining establishments, entertainment venues, and residential spaces, projecting a comprehensive entertainment complex designed to draw significant footfall.

In line with the phased approach to the project, GLPI has outlined specific timelines for the financial disbursements. The land acquisition is scheduled for completion in the first quarter of 2026, while the construction financing will be disbursed incrementally from late 2026 to early 2028. This structured financing aligns with the development stages, ensuring financial fluidity and project momentum.

During construction, GLPI has instituted a rent escalation mechanism with The Cordish Companies, a key developer and operator for the project. The arrangement entails rent payments on GLPI’s funding, with a structured annual uplift of 1.75% commencing a year after the casino becomes operational. This financial model ensures immediate cash flow for GLPI while securing long-term revenue growth, showcasing the company’s adeptness in leveraging real estate assets to bolster shareholder value.

GLPI’s strategic framework is further highlighted by its previous acquisitions, such as the $183.75 million Sunland Park Racetrack & Casino deal in New Mexico, which was secured at an 8.2% cap rate with a similar triple-net lease structure. These acquisitions demonstrate a consistent strategy of adding high-quality assets to its portfolio under appealing financial conditions.

However, such substantial investments are not without risks. GLPI’s significant debt levels mean that rising interest rates could affect its financial margins. Moreover, the success of the Live! Casino & Hotel Virginia project is contingent on regulatory approvals and the performance of its tenants, reflecting the complex interplay of factors influencing gaming real estate investment trusts (REITs).

Despite these challenges, market analysts like those at Barclays remain cautiously optimistic. In October, the financial institution upgraded GLPI to an Overweight rating, underscoring the potential upside from GLPI’s strategic acquisitions and its resilient tenant base, which includes key players like Bally’s.

Bally’s, a crucial tenant for GLPI, is currently navigating debt restructuring, highlighting the interconnected risks within the gaming REIT sector. Yet, GLPI’s recent $735 million sale-leaseback agreement with Bally’s for the Twin River Lincoln Casino Resort in Lincoln, Rhode Island, underscores its ongoing commitment to strategic acquisitions, though this deal faces temporary delays due to creditor claims against the seller.

Nonetheless, GLPI’s focus remains on acquiring properties in smaller, stable markets, a strategy designed to mitigate risks and capitalize on less volatile economic environments. As the Live! Casino & Hotel Virginia project progresses, it stands as a testament to GLPI’s robust investment strategy and its ability to adapt to a dynamically evolving gaming landscape.