In a surprising turn of events, a document leak from the UK’s Office for Budget Responsibility (OBR) revealed plans to significantly raise the remote gaming duty to 40% by April 2026. This proposal, much harsher than the 30-35% increase most industry insiders had braced for, ignited widespread concern across the UK gambling market.

Shares in major operators such as Entain, Flutter, and Evoke saw immediate declines, ranging from moderate single-digit losses to nearly 20% for some companies. This market reaction came even before the formal budget announcement, as investors were caught off guard by the dramatic scale of the proposed tax changes. The new 40% rate represents an almost doubling of the current 21% duty, a move that industry representatives warn could drive many online casinos, especially those with thin profit margins or significant marketing expenses, into financial distress. Although the abolition of the 10% bingo duty was also announced, it offers scant consolation to operators now bracing for a much heavier tax burden.

The leak further disclosed that the Treasury aims to generate GBP 1.1 billion (approximately $1.46 billion) annually from these revised gambling duties by the fiscal year 2029-30. However, this projection assumes a decrease of about one-third of potential revenue, as officials anticipate that the higher taxes could prompt consumers to turn to offshore gambling sites or reduce their betting altogether. This potential shift in consumer behavior is a concern for the Treasury, which had hoped for a more substantial boost in revenue.

Looking ahead, the tax overhaul plans for additional changes in 2027, including the introduction of a new 25% general betting duty. Notably, this rate will exclude spread betting, pool betting, and horse racing, following successful lobbying efforts from the horse racing industry for an exemption. Traditional casino duty rates will be frozen temporarily, returning to standard inflation-linked adjustments after a year.

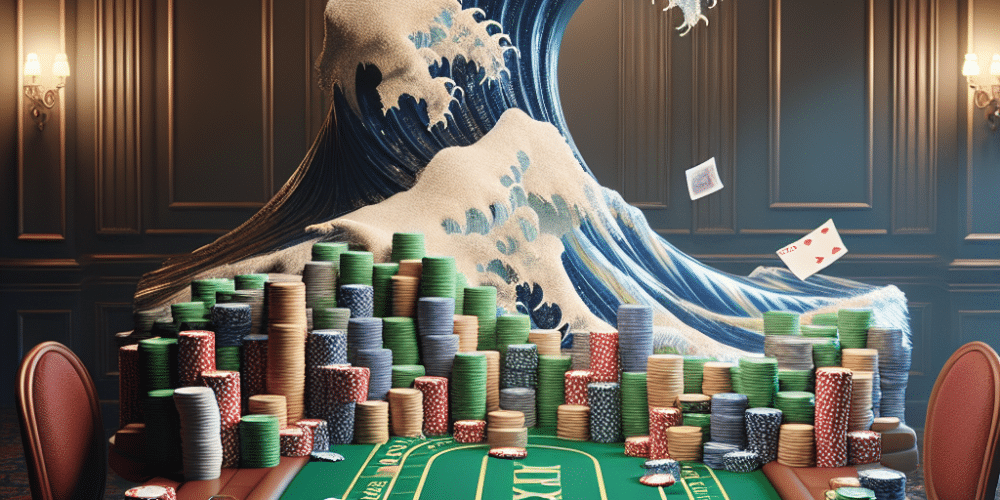

Industry insiders express apprehension that these sweeping changes may trigger unintended ripple effects, such as job losses and the closure of smaller businesses unable to absorb the increased costs. Flutter’s Sky Bet has already preemptively relocated its headquarters to Malta, a strategic move projected to save substantial tax liabilities and possibly setting a precedent for other companies. Analysts foresee a wave of similar relocations and potential mergers as companies seek to mitigate the impact of the new tax environment.

The OBR suggests that over time, gambling operators will need to adapt their offerings to counterbalance the tax hikes. Yet, in the short term, the sector is bracing for a challenging period of adjustment. While a 40% tax hike is not the worst-case scenario previously floated, it hovers dangerously close. Boards and investors must now face the harsh reality that the UK gambling market is poised for contraction.

Nevertheless, some voices in the industry argue for a different perspective, suggesting that the tax increase could ultimately drive necessary reforms. By pushing less efficient operators out of the market, the higher duty could pave the way for a more robust and sustainable industry in the long run. These optimists contend that, with strategic adjustments and innovation, surviving companies could find new avenues for growth and profitability despite the initial setbacks.

The forthcoming tax changes, which reflect broader governmental efforts to regulate and control gambling, aim to address concerns about problem gambling and to ensure that the industry contributes fairly to public finances. Proponents of the tax increase argue that it aligns with global trends towards more stringent regulation of gambling activities, emphasizing the need for the industry to operate responsibly and ethically.

However, detractors warn that the UK’s gambling sector is at risk of losing its competitive edge on the international stage. As companies potentially relocate to more tax-friendly jurisdictions, the UK could see a decline in its status as a hub for gambling enterprises. This shift could lead to a loss of jobs and economic activity within the country, further complicating the government’s fiscal and regulatory objectives.

As April 2026 approaches, the gambling industry is poised for significant transformation, driven by the impending tax changes. The outcome will largely depend on each company’s ability to adapt and innovate in this new environment. While some may succumb to the pressures of increased taxation, others could emerge stronger, having navigated through the turbulence with strategic foresight and operational agility. It remains to be seen how these developments will reshape the landscape of the UK gambling market in the years to come.

David Harrison stands tall in gambling journalism, marrying his firsthand casino experiences with a deep understanding of betting psychology. His articles transform complex gambling jargon into engaging tales of strategy and chance, making the world of betting accessible and enjoyable. David’s knack for narrative extends beyond print, making him a sought-after speaker on gambling trends and future bets. In the realm of gambling, David is both a scholar and a storyteller, captivating readers and listeners alike.