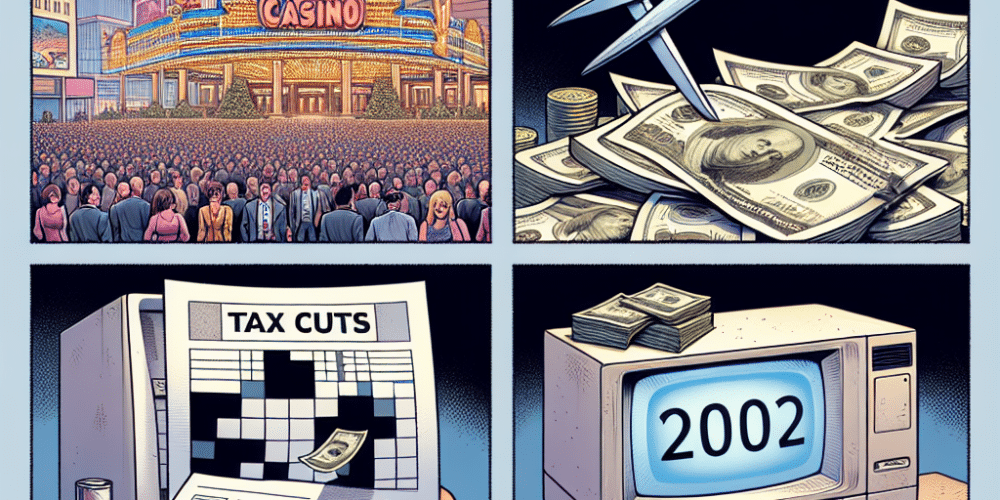

In 2023, Pennsylvania homeowners are set to benefit from over $1 billion in property tax reductions, thanks to casino revenues—a record amount since the inception of the program nearly two decades ago. While this has been a relief to many, there is growing scrutiny over whether the calculations used to determine these payments, rooted in methods from 2002, are still relevant given today’s economic landscape.

The Homestead and Farmstead Exclusion programs, part of the 2006 Taxpayer Relief Act, annually reduce school property taxes for eligible homeowners. These reductions are funded by a 34% tax on slot machine revenues, which contributed approximately $6.4 billion to the total casino income last year, according to Trib Live. The Pennsylvania Gaming Control Board documented that slot machines alone generated around $2.4 billion, with online gaming contributing a similar figure.

Alarmingly, Pennsylvania’s Department of Education confesses that it still relies on 2002 data to allocate funds across the state’s 500 school districts. This means that crucial factors like district wealth, student enrollment, and tax collection metrics have remained static, despite significant demographic and economic shifts over the past two decades.

This outdated system can lead to discrepancies in tax relief benefits. For instance, homeowners in rapidly developing regions may not receive adequate assistance that reflects their current property values or burgeoning populations. Conversely, areas with declining populations might still benefit from generous allocations based on outdated figures. Take Allentown as a case in point, where property owners will enjoy approximately $1,032 in savings on their 2025–2026 school taxes. In contrast, residents in the Mars Area School District will see a modest $102 reduction. Meanwhile, in parts of Westmoreland County, where property values haven’t been reassessed since 1972, homeowners will save between $130 and $172.

Calls for Legislative Review and Reform

George Dunbar, a former state representative and a member of the Gaming Control Board, remarked that while the tax relief is tangible, it often goes unnoticed by residents. Many people don’t realize the benefits of the Homestead deduction because their mortgage escrow accounts manage tax payments automatically.

Despite the relief provided, the fund’s growth is lagging behind the escalating costs of education. Analysts like Elizabeth Stelle from the Commonwealth Foundation argue that while gambling revenue is certainly beneficial, it fails to mitigate the increasing reliance on property taxes to finance schools. Stelle emphasizes that the outdated data skews the equitable distribution of benefits.

Local officials, such as Ryan Manzer, the financial manager of Plum Borough, appreciate the financial support but advocate for a comprehensive data update to reflect current growth patterns. The state’s lawmakers, however, are divided on the need to reevaluate the distribution formula. State Senator Jay Costa acknowledges that while the system is operational, revisiting it could enhance fairness. Yet, some legislators contend that the focus should be on broader educational funding reforms, rather than solely on the allocation of casino-generated funds.

A Broader Debate on Educational Funding

The conversation about casino-backed property tax relief has sparked a wider debate regarding the overall funding strategy for public education in Pennsylvania. Critics argue that the reliance on property taxes continues to place a disproportionate burden on homeowners, while potentially exacerbating inequalities among school districts.

Proponents of reform suggest a more holistic approach to revising the state’s educational funding model. This could involve reassessing property values more frequently to ensure that tax obligations align with current market conditions, thereby creating a more equitable system for all stakeholders.

Opponents, however, caution that frequent reassessments could destabilize local economies and cause financial strain for homeowners unprepared for sudden increases in tax liabilities. They advocate for maintaining the status quo, emphasizing the importance of stability and predictability in tax obligations.

Navigating the Future of Tax Relief

As Pennsylvania continues to navigate the complexities of funding education through casino revenues, the call for a data-driven approach to tax relief distribution becomes increasingly pressing. Ensuring that financial assistance mirrors the dynamic changes in population and economic conditions will be critical to maintaining the program’s legitimacy and fairness.

Ultimately, the debate underscores a broader challenge facing many states: balancing the need for adequate educational funding with the desire to minimize the financial burden on taxpayers. As the state considers potential reforms, stakeholders from various sectors will need to engage in thoughtful dialogue to devise solutions that equitably address the needs of all Pennsylvanians.

With the conversation ongoing, Pennsylvania’s experience serves as a cautionary tale for other states relying on similar funding mechanisms. As economies evolve, so too must the systems designed to distribute financial resources equitably and efficiently. Whether Pennsylvania will lead the way with innovative solutions or continue to rely on outdated models remains to be seen, but the stakes for homeowners and students alike are undeniably high.

Garry Sputnim is a seasoned journalist and storyteller with over a decade of experience in the trenches of global news. With a keen eye for uncovering stories that resonate, Alex has reported from over 30 countries, bringing light to untold narratives and the human faces behind the headlines. Specializing in investigative journalism, Garry has a knack for technology and social justice issues, weaving compelling narratives that bridge tech and humanity. Outside the newsroom, Garry is an avid rock climber and podcast host, exploring stories of resilience and innovation.